Global Industrial Outlook

Global Industrial Outlook

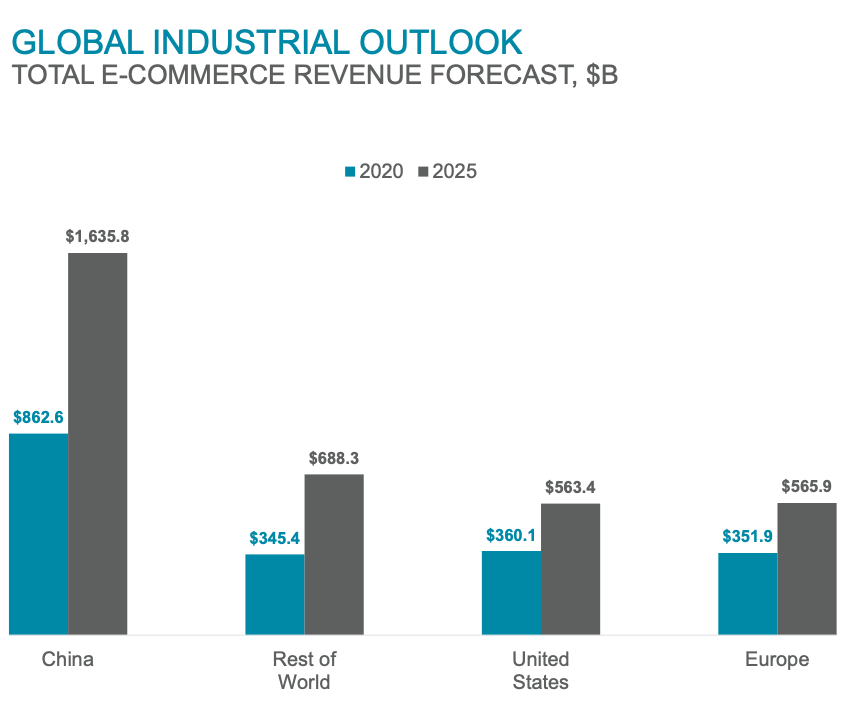

COVID-19 amplified the growth of e-commerce as lockdowns and safety concerns prompted more consumers to shop online. As a result, several years of online sales growth were condensed into 2020 alone, causing logistics-related leasing to support fulfilment to surge. We expect the continued growth of e-commerce to bolster demand of industrial real estate.

AMERICAS

- 2020 marked an all-time high for new leasing and expansions with over 650 msf of leasing activity.

- At 5.2%, U.S. vacancy remains anchored near historical lows (4.8%).

- Rent growth remains impressive. Average asking rents for all classes of logistics product grew 6% year-over-year, with institutional-grade logistics product up 12%.

EUROPE

- Q4 2020 take-up across Europe was the strongest on record with all regions up year-over-year.

- Impressive year-over-year gains in take-up occurred in Central & Eastern Europe (+28%) and Western Europe (+10%).

- European prime asking rents grew 14% year-over-year in Q4 2020 with broad-based gains. Central & Eastern Europe (+21%), Southern Europe (+18%) and Western Europe (+12%) saw the strongest gains.

ASIA PACIFIC

- Throughout Asia, logistics and industrial leasing remains brisk, and market conditions are tight.

- Across Greater China, vacancy fell 220 bps in 2020 to 12.5% with vacancy in Mainland China falling 210 bps to 12.9%.

- Similarly, logistics vacancy in Singapore fell 190 bps to 10.1%, while vacancy in industrial parks in Vietnam fell by 80 bps.

- Strong leasing and tight market conditions translated to impressive rental growth with average asking rents for all classes of space rising 8% in Mainland China and 6% across Greater China.